Sandeep Aggarwal case: Lessons for professionals

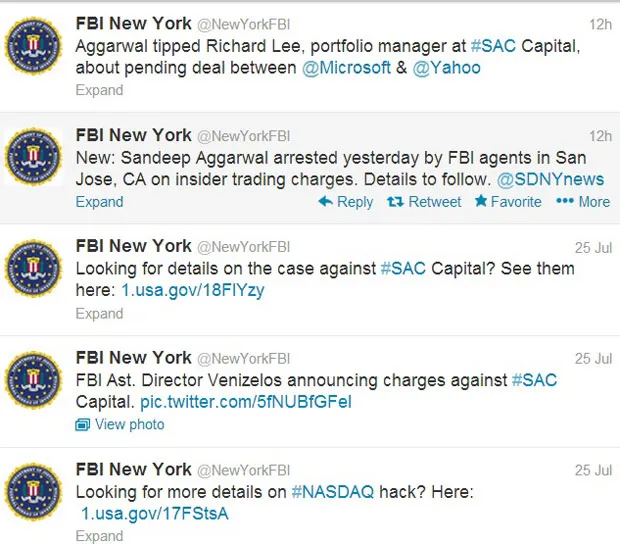

“Aggarwal tipped Richard Lee, portfolio manager at #SAC Capital, about pending deal between @Microsoft & @Yahoo.” Thus reads the last of the series of tweets about Sandeep Aggarwal on FBI New York’s twitter page (@NewYorkFBI). Days before the arrest of Aggarwal by FBI agents in San Jose, CA on insider trading charges, there was a tweet about ‘FBI Ast. Director Venizelos’ announcing charges against #SAC Capital.

The latest charges, as in a press release of SEC that describes Aggarwal as a ‘tipper of confidential information,’ are the violation of Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5; and the SEC complaint “seeks a final judgment ordering Aggarwal and Lee to pay disgorgement of ill-gotten gains plus prejudgment interest and financial penalties, and permanently enjoining them from future violations of these provisions of the federal securities laws.”

Of relevance is the quote of Sanjay Wadhwa, Senior Associate Director of the SEC’s New York Regional Office, cited in the SEC press release, that as a sell-side analyst, Aggarwal knew the rules and yet he broke them, “which is why he joins the growing ranks of those held accountable by the SEC for insider trading.”

A quote of impact is of Preet Bharara, the United States Attorney for the Southern District of New York, given in the FBI press release dated July 30, 2013 – that with Aggarwal’s arrest, “we continue our work to investigate and prosecute privileged professionals who think the laws requiring honesty and fair play do not apply to them.”

Five days earlier, Bharara had been quoted, in the context of charges against SAC, that a company reaps what it sows. “SAC seeded itself with corrupt traders, empowered to engage in criminal acts by a culture that looked the other way despite red flags all around. SAC deliberately encouraged the no-holds-barred pursuit of an ‘edge’ that literally carried it over the edge into corporate criminality.” Bharara added that companies, like individuals, need to be held to account and need to be deterred from becoming dens of corruption.

Then comes the warning, thus: “To all those who run companies and value their enterprises, but pay attention only to the money their employees make and not how they make it, today’s indictment hopefully gets your attention.”

An instructive case that is unfolding, with important lessons for professionals.