Vodafone launches Africa’s digital money M-Pesa in India; now your SIM is powered to pay for everything

Hello India, your SIM card can now act as a debit and credit card. No more carrying cash. You already carry your phone with you everywhere, now also carry your money in it and get freedom from carrying cash/credit/debit cards.

Imagine after eating at your favourite pani-puri stall, instead of paying by cash you ask the pani-puriwala his M-Pesa ID and transfer the amount to his account. Or you ride a rickshaw back home from work, and pay the autowalla with your phone. No worry about loose change here!

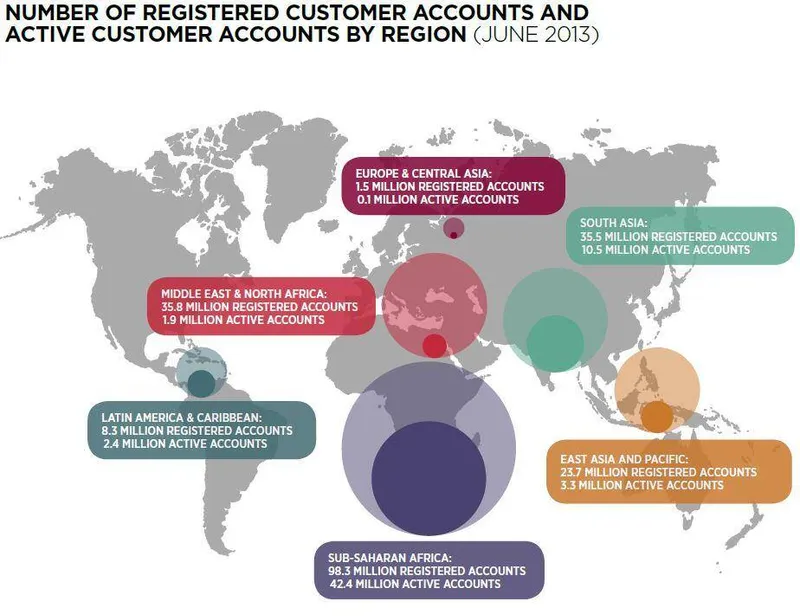

M-Pesa (M for mobile, ‘pesa’ is Swahili for money) is mobile money that was developed by Safricom in East Africa, Kenya. And it’s the most mature mobile payment system in the world at present. M-Pesa has spread quickly, and has become the most successful mobile phone based financial service in the developing world since its launch in March 2007.

Twenty five percent of $78 bn Kenya’s (GNP) gross national product flows through M-Pesa transaction. Around one-third of Kenya’s population uses the service to transfer small amount of money to other people and merchants via their mobile.

Very few financial inclusion initiatives have been as successful as M-PESA. Over 70% of adults in Kenya use M-Pesa and more importantly over 50% are the poor, unbanked and rural populations. The continuing success of M-Pesa has been due to the creation of affordable payment service with only limited involvement of banks. This is a true testament of financial inclusion.

Digital paise for everyone in India – banking by phone

Vodafone has been piloting M-Pesa in India along with ICICI Bank, India's largest private sector bank. M-Pesa provides branchless banking service, it allows Vodafone subscribers to deposit cash to and withdraw cash from their accounts by exchanging real cash for electronic cash at a Vodafone network of retail stores (at bricks-and-mortar money transfer agencies).

M-Pesa allows users to transfer funds to other users, to pay bills and to purchase mobile talk-time credit, DTH recharge, prepaid recharge, pay bills, deposit money, withdraw cash and transfer funds. All of M-Pesa transactions are authorized and recorded in real time using secure short messaging service (SMS). The service is designed to enable users to complete basic banking transactions without visiting a bank branch.

The highlights of M-Pesa

Safe and secure - Every transaction is initiated from an active Vodafone mobile number and using a confidential PIN.

Simple to use - All the instructions are carried out through simple messages. The menu for the transactions can be accessed by dialing *400#. (No internet connection, GPRS or a smart phone required to access your account) OR by dialing 55400 from your registered Vodafone mobile number.

Saves time - No more standing in long queues, rushing during working hours for your banking transactions or traveling long distances for depositing or withdrawing money.

Convenient - It's as convenient as sending an SMS.

M-Pesa service in India will be available across authorized Vodafone agents and exclusive stores. M-Pesa service can be accessed only by Vodafone subscribers but they don’t have to be an ICICI bank account holder. M-Pesa has over a million users in India. Apart from Karnataka and Tamil Nadu, M-Pesa has been rolled out in Delhi, Mumbai, Kolkata, West Bengal, Punjab, UP East, UP West, Bihar, Jharkhand, Rajasthan, MP, Chhattisgarh, Gujarat, Maharashtra, Goa, Assam and the North East, Odisha and Haryana. In the next few months, Vodafone will make M-Pesa available pan India.

Early adopter parties, AAP & BJP

Since it is election season in India, the new political party known for its grassroots and social media activism, Aam Admi Party (AAP), has adopted M-Pesa to collect donation. The other party that joined the M-Pesa bandwagon is the Bharatiya Janata Party ( BJP). Both the parties use the M-Pesa platform for accepting donations.

As per Reserve Bank of India rules, Rs 5,000 is the maximum amount that can be transacted in a day while not more than 25,000 can be transferred in a month in a given user ID. M-Pesa empowers huge part of migrant population which lives in the metro cities and want to send money back to their villages but do not have a quick, safe and reliable way to do it.

In the absence of banks and ATMs, M-Pesa lets users withdraw cash from designated outlets with a condition that the receiver of the cash fulfills KYC (Know Your Customer) norms with Vodafone. This is a breath of fresh air for people who have to travel 10-15 km in rural area to access the nearest banking service.

Vodafone has around 17 lakh outlets across the country. It will appoint 50,000 agents to disburse money through their agents in addition to 660 Vodafone-branded rural stores. A mobile phone text message is all that is needed to pay for everything from utility bills and school fees to train and flight tickets, even for your morning newspaper and milk man.

Two Dos & Two Don’ts

Open M-Pesa account with a minimum balance of Rs. 100 plus the activation fee.

Carefully check the mobile number of the beneficiary before making any payment.

Don't share your PIN with anyone not even with M-Pesa agent or customer care representatives.

Don't leave agent's store till you receive a SMS confirming your transaction.

This is not the first time a product that was developed in Africa came in search of growth in an emerging market like India. YourStory had written about the South African Mxit entry to India in January.