iKaaz launches social and merchant centric Android app for money transfer on the go

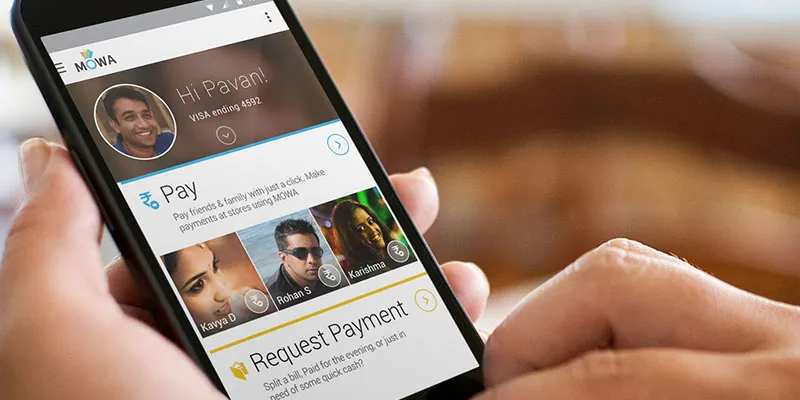

Bangalore-based mobile payment platform, iKaaz has launched Android app MOWA, a simple mobile payment enabler on the go. The app facilitates consumers and merchants to make and receive payments in an easy and convenient manner, based on their mobile number. It enables sending money through the mobile to any phone number without sharing private bank account details of sender or receiver.

Importantly, the app is free and supports all banks in India. MOWA has been launched jointly by iKaaz and DCB Bank. It helps you manage your cards to make payments as well as bank accounts to deposit money.

Unlike other money transferring apps, MOWA requires no pre-payment of account as consumers’ money resides in their own bank account until they do the transaction. The users can avail the app by registering with their mobile number, name and date of birth. Later, user has to attach the credit or debit card as a payment medium.

The money is debited from the payer’s card only at the time of the transaction and deposited directly into the receiver’s bank account. Apart from paying merchants and sending money to friends and family, the app can also be used for mobile recharge for self and others, pre or postpaid, data or DTH, bill payments, among others.

With this app, millions of merchants who don’t have a point-of-sale (POS) terminal can now accept digital payments. Consumers can use this for paying merchants, friends and family. The app comes with multi-level security for authentication and transaction, and is compliant with RBI regulations.

Soma Sundaram, Founder & CEO, iKaaz commented, “Our team has been constantly working towards providing the safest and easiest ways of mobile transactions and driving the economy towards being cashless. iKaaz is already processing millions of transactions with its comprehensive suite of end-to-end mobile payments solutions and we are confident of seeing mobile app based remote payments and NFC powered ‘tap & pay’ based retail payments as the future of mobile payments.”

DCB Bank is an emerging new generation private sector bank with 149 branches in 98 locations across 17 states and 2 union territories. MOWA competes with Oxigen, Airtel Money and MoneyonMobile among others.

Last year, iKaaz joined hands with Adiga’s to rollout cashless payments at the chain of traditional South Indian restaurants run by Adiga’s in Bangalore.

Besides India, the Bangalore-based startup also expanded its footprints in African countries like Nigeria and Kenya last year. Currently, it operates on a B2B model, providing the platform and associated ‘tap & pay’ solutions on a licensing model in Nigeria and Kenya.

App link: MOWA