Last week, I got an email from a solid entrepreneur building real stuff saying he was in desperate need of funds and was okay to raise even $1 million. The same entrepreneur originally started his fundraise process with a $12-million ask about one quarter back.

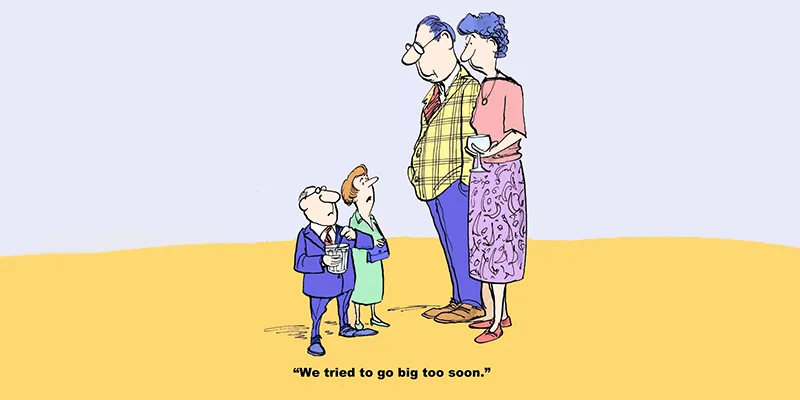

Over the last few months, I have observed a similar situation playing out across multiple startups, where the entrepreneur originally starts fundraise process with ask of $10 to $15 million. After a couple of months, the entrepreneur is okay to raise any amount. And in the end, on many occasions, the funding doesn’t happen at all.

I tried to find out what exactly goes on in such situations and why even good entrepreneurs reach this unfortunate situation. Here is what I have come to understand and my thoughts on how to avoid it.

Quite often, the $10 to $15 million number is inspired by other funding announcements in media. In fact, these days many old yet unannounced rounds are being announced in the media, creating distorted expectations. Second most popular reason is to build enough dry powder reserve before market completely dries up.

Now, an interesting dynamic starts emerging with this ask of $10 to 15 million. In today’s funding landscape, many investors give blind pass to such high-risk deals. Many others, just keep the company hanging around (without saying no), so they have an option to jump in later if funding is actually happening.

After a few weeks, cash crunch starts becoming more visible to investors and they become even more cautious, further aggravating the situation. A few more weeks later, the entrepreneur accepts reality and goes back to the investors saying, “We are reducing the round size and okay to raise any amount of money.”

This obviously means that no one funded the company. And why would anyone invest in a company that’s struggling to raise funds in the market (remember: investment world is full of herd behavior). This basically creates a seriously negative virtuous cycle and makes it impossible to raise any amount.

Don't miss this: What does a VC look for in a startup?

So what could be done to avoid getting into this situation?

I think the key is to manage demand well. It’s much better to be in a situation where three funds are willing to put in $4 million, than where no fund is putting $10 million. Then you can easily increase the round size to support high demand. Seeing your demand among other investors will be a great confidence boost for your potential investors and gives you the ability to raise the round size.

Here are few more actionable things to plan better:

- Most importantly, have an honest sense of reality of your product’s traction. Set your expectations based on genuine progress in business rather than being influenced by media. Trying to bargain from a higher number is not good for you.

- Talk to your existing investors. If they are a good set of folks, they should help you estimate the right range of funding. You can hit the market with this range and then adjust based on reactions.

- Talk to a bunch of other entrepreneurs who are raising funds in the market and learn from their experiences.

To succeed, you need to survive longer than everyone else. And to survive you need money. So don’t compromise on your chances of raising money for stupid reasons.

Read next, from the same author: What are you building – a business, product or hack?

Disclaimer:

- Read my personal views on various things related to the world of startups at alokg.com.

- I’ve written this as an individual and the article has no connection to any of organizations that I am engaged with or have been in the past.