Deconstructing and reassembling the Indian consumer opportunity in online lifestyle

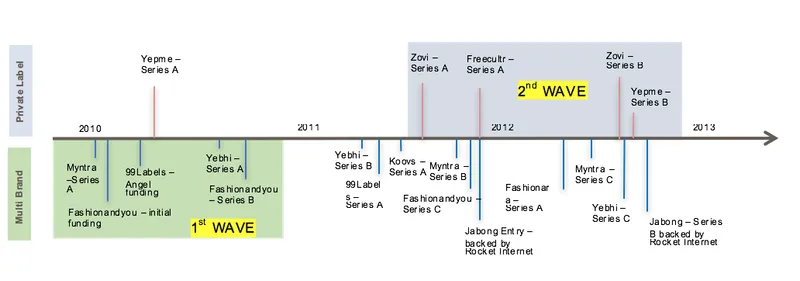

Larger tickets from Venture Capital firm started to flow into the online lifestyle category be 2009/2010, Rocket Internet started operations in 2011 with its flagship Jabong.com.

During the first wave of online fashion, the focus was on importing, investing & scaling successful business models from abroad (Zappos, Zalando, Asos, etc.) and reaping the strongly growing online Indian consumer opportunity. The notion was that India is going to be a very large market in the decade to come and that now (2008-2010) was the right time to place the bets to get a piece of the Indian consumer opportunity. One of the key epiphanies (still is today) was that internet penetration was low, yet the number of online users was fairly big. The rapidly increasing internet penetration and the implications in terms of the sheer number of internet users, particularly when benchmarking with other BRICS, stunned global investors.

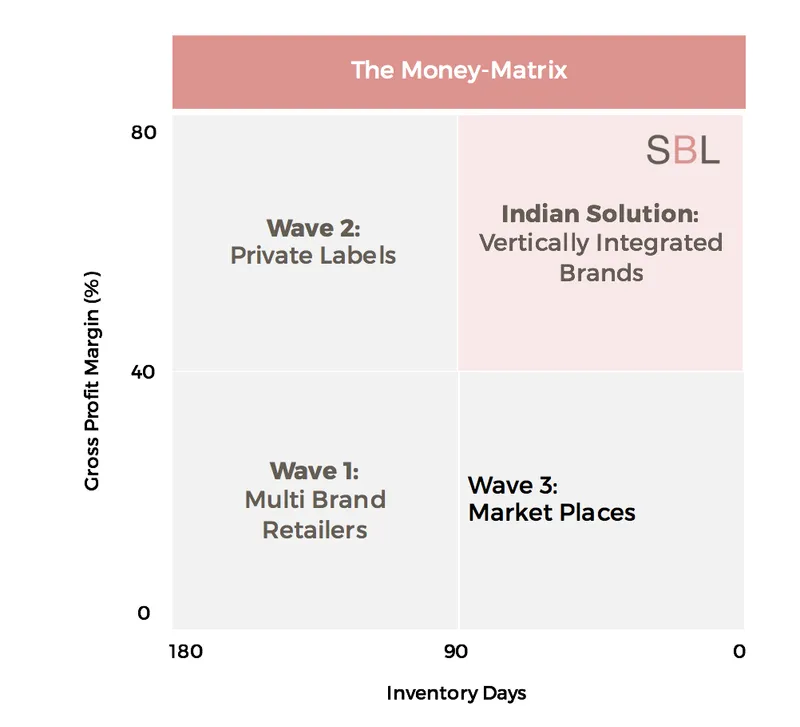

Obviously, economics for these businesses were though, not only because of the margins/ discounting but also because of inventory. However, the single most online India defining KPI that we tend to forget is the basket size; same business models with same margins abroad make more sense because they have 2x to 3x the basket size: 30% on $20 is $6, while 30% on $50 is $15 – that’s more than twice the gross profit that hits your P&L for each transaction.

In the second wave the idea was to counter difficult economics with margins: a great simple idea. “Instead of selling third-party products at lower margin, let me go private label, sell the same thing and make more money”. The problem with private label businesses in the lifestyle segment is what I call the “Golden Hand Problem”. In private label businesses the onus on picking (buying) that right style (where right means it will sell well at a full margin) is on the company/ private label brand itself. Multi-brand retailers can bank on their vendors, which are brands, to solve the “Golden Hand Problem” for them.

What happens if you do not solve the “Golden Hand Problem” or do not have a team member with a “Golden Hand”/ Karl Lagerfeld in your business to do the style picking for you? Well you actually end up being in a worse position than companies in the first wave; while you might have a better margin profile, you start piling up inventory – a lot of it. As we know, Inventory eats into cash and the sneaky thing is: It does not even show in your P&L, only on your cash. In the worst case, your business become less capital efficient than that of multi-brand retailers, because you can not move your inventory.

The third wave are market places – Applying Chinese learnings in the Indian context

The third wave, which I refer to as the china wave, got accelerated during and shortly after the AliBaba IPO. In this wave the idea was to follow the success formula Chinese companies and establish market-places, where the inventory is completely cut out of the game. “Surely, this way Indian economics start making sense, because you cut inventory risk out of the game”. In principle, this is absolutely correct in china; and of-course there will be successful market place businesses in India, just not at as successful as in china.

Here is why market places in India face challenges:

- The basket size in India is just too small in the lifestyle category: Yes, you don’t carry any inventory; but the price you pay for this – in market places models – are super low margins. If I sell 1000 INR worth of merchandise (GMV), I end up of having a take rate of roughly 10%? That’s 100 INR per transactions that service your entire marketing spend (a lot of freaking marketing spend) & overheads. Even if you scale this company to Chinese levels – it is going to take A LOT of transactions/ burn until profitability.

- At the same time, India is nowhere close to the size of China. This means you will not be able to scale such a company to Chinese levels anyways. Let’s be real India is as big as the UK/ Germany in terms of GDP. What’s exciting about India is the stable & high consumer driven growth rate; not the size today but the size tomorrow! High margin consumer businesses in the offline space capture this characteristic in supremely high yet stable EV/EBITDA multiples. I refer to the latter as the “true” Indian opportunity in this segment

- Supply Side quality just does not compare for goods coming from Indian vendors in the lifestyle segment. The Chinese advantage was that China built high quality products and thus built a high quality supply-chain for the entire world before Chinese online consumers started tap exactly those supply chain structures. In India we still differentiate between “Export Quality” & “Domestic Quality” – implying that it is ok to have inferior quality for the domestic market – often at roughly similar price levels. At the same time, Indian consumers are evolving rapidly and demand world-class products. Often times, market places are not able to fulfil customer expectations and hence the CLV will suffer twice (Low take rate, low repeats, low basket size – the worst of everything; you need an unreasonable low CAC to make sense of this).

The Indian solution

Ultimately laws of physics still apply in India: Given the lower basket sizes, which is pretty much an external factor if you want to tap the belly of the market. How do we extract more value out of each transaction, i.e. out of each customer to build profitable large consumer businesses then? Such businesses that reap the true Indian advantage in the consumer segment are companies that enjoy supremely high value multiples due to profitable, fast growing consumer propositions for domestic India – sadly there are so few of them.

So how to reap this true India advantage? Simple answer: You need a highly capital efficient business that can scale well. But how do you create this?

By solving the golden hand problem in a systemised way and going deep into the supply chain, which means generating a superior margin but making sure to solve the inventory piece, too; simply higher margins will not suffice. You need a high GPROI – Gross Profit Return on Inventory. The new breed of tech-enabled consumer companies, will be online vertically integrated brands – not eCommerce companies that can crack GPROI and Customer Economics in a way that creates new models specific to India.

The focus must shift away from being the biggest to delivering the best, differentiated product as efficiently as possible – such companies in India are priced really highly by global & domestic capital

- Full stack margins & efficient inventory handling (High GPROI)

- Supply Side differentiation, defensibility

- Brand creation & style picking that allows to charge a premium and allows for your products to sell like hot cakes at the same time (solving the golden hand problem in a systemised way to create/ curate products customers want to pay a full margin for)

Once a model with really high GPROIs has been crafted, start looking at the customer/ demand side economics applying the standard CLV/CAC logic to scale it rapidly, yet profitably.

The solution to India will be the opposite to what was the solution in China – the Indian Antithesis. Because supply structures are not built, India needs to control the entire supply chain in a lean, novice and efficient way; this will create innovative vertically integrated businesses that will create high-quality domestic supply to cater to domestic demand that wants world-class products. At the same time, this opportunity allows for domestic consumer brands with world-class products to emerge.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)