Bangalore-based startup helps the neglected blue-collar sector Avail Finance

Avail Finance, which aims at financial inclusion and has tied up with Ola, has disbursed 500 loans till now and aims to chalk up 50,000 loans by 2019.

The journey for Ankush Aggarwal, 25, started in August 2014. Interning with one of the biggest cab aggregators in the country, he was part of the team that launched Ola Auto, an auto hailing feature.

Before the launch, the team was required to speak to hundreds of auto drivers, and Ankush found out a recurring problem of insufficient credit.

Lacking credit history, this income segment – blue-collar workers – is largely ignored by banks and bigger institutions. Banks considered it extremely risky to cater to this category due to fluctuating incomes.

But to this University of Illinois graduate, it seemed like a market opportunity up for grabs. And that marked the start of Avail Finance.

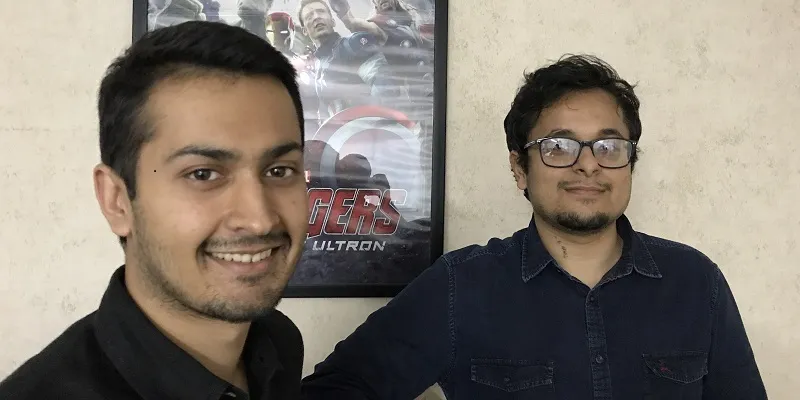

Ankush co-founded Avail Finance with Tushar Mehndiratta, an alumnus of IIT Roorkee. Tushar, who had previously worked with Adobe, was introduced to Ankush by a common friend and they hit it off.

Helping avail finance

Their venture, started in February this year, is an app-only platform that provides easy personal loans to the salaried blue-collar segment.

The firm describes its customer base as individuals earning anywhere between Rs 12,000 and Rs 20,000 per month, those who are either newly married or have shifted to a new city in search of a job and are finding their feet.

To facilitate these loans, the firm has taken the route of partnering with aggregators (cabs and other services), making it more of a B2B2C model than a B2C one. This helps the startup in multiple ways, apart from giving them access to a pool of potential customers. Ankush explains,

Our customers are usually individuals who don’t have any credit history. Partnering with aggregators allows us to get an insight into their employment history and work performances, giving us more underwriting data to assess the credit worthiness of customers.

The company has partnered with Ola and disburses loans to its drivers.

Apart from employment data, the firm picks up social imprints and does psychometric tests to better understand the credit worthiness of customers.

Dreaming of an NBFC

At present, the firm is lending capital raised by micro-finance institutions (MFIs). Ankush did not divulge any names but says only small MFIs are lending; the big lenders find this segment risky.

However, Avail Finance plans to apply for an NBFC licence early next year and disburse its own capital.

The firm, which gives small short-term loans of Rs 15,000 and Rs 20,000, grows its revenues through upselling. This means it gives loans of small amounts first and, depending on the customer’s re-payment history, decides whether or not to disburse bigger amounts. The highest loan amount offered on the platform is Rs 50,000.

Avail Finance makes revenues by charging a 2 percent processing fee from the MFI, after the loan is fully paid by the customer. It also charges a one-time registration fee of Rs 400 from customers signing up on the platform.

The average interest at which loans are given on the platform is also 2 percent.

Avail Finance and other such players have a strong differentiator when compared to LoanAdda and LoanMeet. The former are looking to solve problems for blue-collar workers while the latter are focusing on sub-prime customers.

Apart from Avail Finance, Mumbai-based financial inclusion startup SERV’D also focuses on the blue-collar segment and is trying to empower them with basic financial products.

Ankush says most customers on the platform take loans for educational, health, marriage or home renovation purposes.

What does the future hold?

Since inception, the firm has disbursed 500 loans, holding a loan book of Rs 1 crore. By 2019, Avail Finance wants to disburse 50,000 loans, building a loan book worth Rs 100 crore.

The firm wants to partner with more aggregators while being present through representatives at the point of need of customers, including hospitals and educational institutes amongst others.

However, the larger aim for Avail Finance is to disburse its own loans and talk to customers directly. The company is also looking to build personalised products for this segment so that loan paybacks are easier.

Avail Finance raised $200,000 in a funding round led by co-founder and CEO of Ola Cabs, Bhavish Aggarwal. It plans to start the process of raising its next round this December.

But in a segment which has a high rate of attrition and unsteady income, how do they take care of defaults?

Ankush explains that the problem is solved by keeping channels of communication with the borrower open. He says,

“We have chosen the aggregator route to avoid defaults. If we fear a default, we opt for manual calling. We even give the borrowers a grace period, but constantly educate and advise them about the repercussions and how they can manage money better.”

Clearly, they’re on the right road.