The US-China trade war and its possible economic impact on India

Since the beginning of the year, the trajectory of the Indian economy seems to be going up. An impressive growth rate of 7.5 percent, which is the fastest among all the major economies in the world, points to the fact that issues like demonetization and the implementation of GST were only short-term blips which are being overcome swiftly. It is needless to say that there is a sense of optimism among the general public, which is reflected in the stock market trends. However, increasing tension between the US and China, and the implementation of tariffs indicate a strong possibility of a full-blown trade war between these two countries.

The impact of a trade war between the superpowers may have implications which may impact the global and the Indian economies. Hence, it is wise to analyse the possible effects well in advance and plan accordingly.

Trade War and Possible Escalation

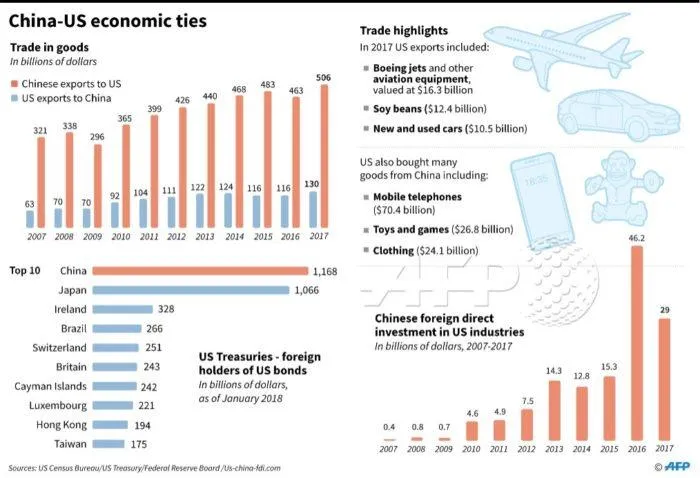

Towards the beginning of the year, the President of the United States of America, Donald Trump, reprimanded China, alleging unfair trade practices and theft of intellectual property. The United States is perhaps one of the biggest consumers of Chinese goods. Hence, souring trade relations between the two meant economic implications for the Asian nation.

Subsequently, Trump imposed 10 percent and 25 percent duty on aluminium and steel respectively coming from all countries except Canada and Mexico. Since the first round of tariffs was announced in June, businesses worth $100 billion out of the total business of $635 billion faced difficulties. This, by no stretch of the imagination, was a trade war. However, the main threat came with the announcement of the $200 billion tariff imposition on China’s export in the latter part of June. This escalation could have a much more profound impact than the first round, which makes many believe that we are on the brink of a major trade war.

How it could affect India

As mentioned earlier, the effects of a trade war are unlikely to be restricted to merely these two countries. Due to this, India too could find some changing dynamics in its economy. The basic principles of economics, i.e., demand and supply, will once again come into play. The shortage of supply of a good, either finished material or raw material, will increase the final consumption price for the consumer. Moreover, the burden of increased tax from the duties will also be borne by the final user. The following are some ways the Indian economy may be affected:

The value of the Rupee

In the last one month, the value of the rupee has dropped to an all-time low, when in some occasions it was hovering around the mid 68s against the US dollar. This coincided with Donald Trump’s threat of imposing a fresh round of tariffs on exports worth $200 billion. This trend can be traced to the weakening of the US dollar, which automatically creates a negative impact on the trade deficit of India, causing a chain reaction of sorts.

Indian stock markets

Amid concerns over the global trade war, key indices in the Indian share market dropped due to the cautious approach of the investors. During this period, the BSE Sensex saw regular plunges in points. NSE Nifty’s performance too was along the same lines as it also saw significant drops. As of now, the Sensex is trading at about 37,521 (at the time of publication), which is still below the average.

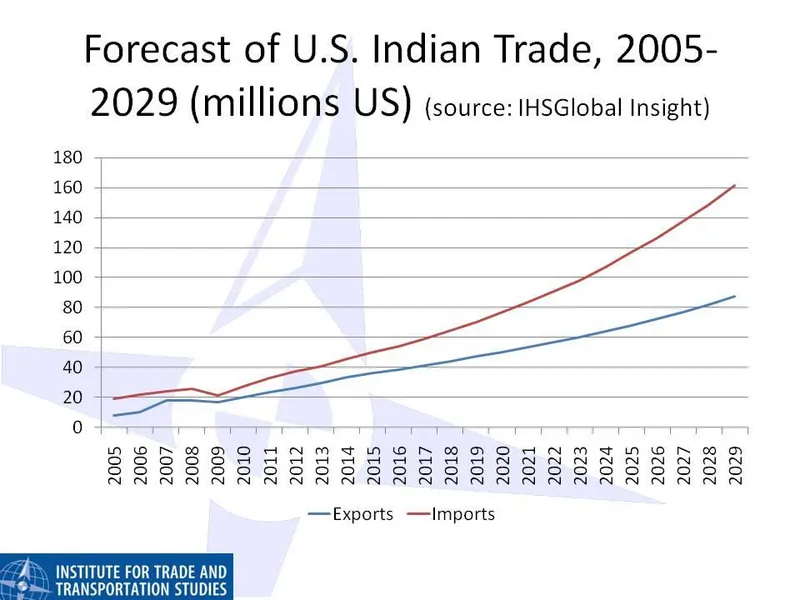

India-US duties

As the United States of America imposed duties on steel and aluminium, India now has to pay approximately $241 million worth of tax to the US. India, on the other hand, as a counter-measure has proposed imposing duties on 30 different types of goods. This will ensure that the US has to pay about $238 million as duties to India. However, this will make life more difficult for the end consumers as everything that falls under the tariff scanner is expected to become more expensive.

As far as the manufacturing industry is concerned, the additional duty imposed could have a detrimental impact, as the cost of production will go up due to the rise in the price of raw materials. Moreover, other things which may face an increase in price include foreign motorbikes with high engine capacity and food products like almonds, walnuts, pulses, etc.

Need for a strategy

Under present uncertain circumstances, Indian CEOs have a significant role to play in keeping the business environment stable. Their strategic plans could prove to be crucial, and hence, there is a need for different plans suitable to different economic environments. Today, the world is witnessing an unprecedented trend of synchronous growth, a growth which is dynamic in nature. Hence, there is a necessity for preparedness for all types of eventualities, as on the other end of the spectrum, if the trade war does not materialise, there is the possibility of tremendous growth in the Indian and world economy.

Gagan Singla is the CMO of AngelBroking, a leading stock broking and wealth management firm in India.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)