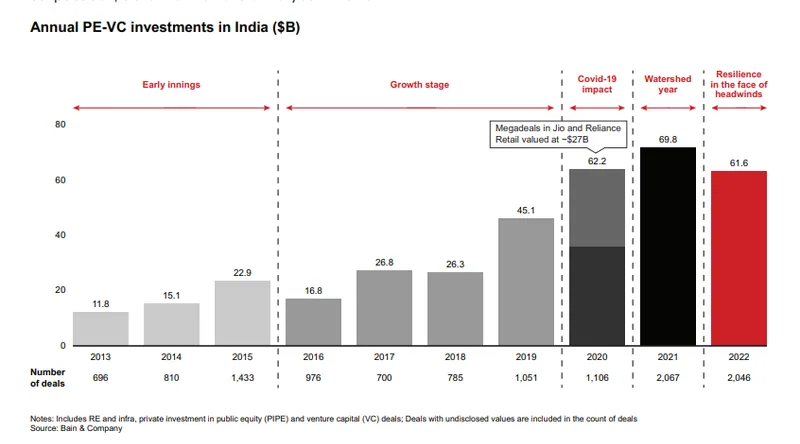

PE-VC investments in India drop by 12% in 2022: Report

The report by Bain & Company and IVCA notes that investors continue to remain bullish on Indian economy given the strong fundamentals

The private equity and venture capital (PE-VC) investments in India dropped by 12% in 2022 when compared to 2021 given the tough macro-economic conditions but the future still remains resilient, says a report.

The India Private Equity report 2023 by Bain & Company and IVCA said, “2022 was a year of recalibration for PE-VC investments in India, declining from the record highs of $70 billion in 2021 to $62 billion in 2022 amid global headwinds.”

However, a point to note is that since 2020, the PE-VC investments in India has surpassed $60 billion.

India’s share of Asia-Pacific grew from ~15% to ~20% in a single year, as China + 1 tailwinds and India’s macro-robustness made the country a bright spot for investing amid decelerating capital flow in the region, the report said.

Unlike in other major economies, Indian PE-VC activity was a tale of two halves through the year—shifting from record deal-making of $40 billion in the first half to $21 billion in the second, marked largely by a drawdown in cheque sizes and a shift in the deal mix, the report found.

Traditional sectors like BFSI, energy, healthcare, and manufacturing grew by around 50% in 2022 due to robust domestic demand. Consumer tech and IT services faced challenges with investment value in these sectors declining by 60% to 70%.

"2022 was a blockbuster year for healthcare exits, and it shows in the fact that the sector saw a 16% share in India’s total PE exits at $3.5B, against only 8% share of investments. The sector is seeing continued potential upside with a low beta, with headroom for growth with large players driving scale through greenfield expansion to Tier 2 cities, brownfield expansion and consolidation initiatives," said Sriwatsan Krishnan Partner, PE Practice, Bain & Company.

Despite the uncertainty in the macro environment for the present, the long term horizon for the Indian economy still remains positive. The report notes that top global and Indian investors expanded their presence in India in 2022 with larger fund-raises, increased India allocations and faster closing riding on the momentum of 2021.

The report said, private equity in India has burgeoned, especially in the last decade. The investor base expanded from about 200 to more than 800 active investors, and there has been an expansion and diversification in pools of available capital and an acceleration in India-focused capital.

Despite an abundance of dry powder, the report noted that the changing sentiment through the year has driven change in the investment approaches. Investors are consolidating focus on fewer, higher-quality assets and driving value creation within portfolios with a dedicated push towards profitability.

This story has been updated to change the headline.